It was a popular demand, although it took nearly a year and a half to arrive. Twitter's former bosses, including its CEO, Parag Agrawal, had millions of dollars in protection against firing when Elon Musk bought the social network, which he later renamed X. However, Musk refused to pay these severance packages and even bragged that he made them Successful. A key step moving forward is closing down the process and firing them appropriately. Now Agrawal and four other directors are demanding $128.6 million (about 119 million euros) in compensation from the owner of the social network in a lawsuit filed in a California court.

The four plaintiffs are Agrawal. CFO Ned Segal; Head of Legal and Content Moderation, Vijaya Gadde, and General Counsel, Sean Edgett. Firing the four was Musk's first decision when he took control of Twitter. These executives were crucial to the legal battle against Elon Musk to force him to buy the social network when he wanted to back out, citing all kinds of baseless excuses.

The operation manual already referred to shields or “golden parachutes,” as the document called them, for many executives. In the lawsuit, Agrawal is seeking $57.4 million; Seagal, $44.5 million; Jade 20 million and Edget 6.8 million. Sarah Personnette, a client manager, who had a shield worth another $20 million, was not included in the first round of layoffs, nor is she a party to the lawsuit. The four plaintiffs are therefore seeking $128.6 million in damages, plus additional just compensation, plus interest, plus legal fees.

This lawsuit is a stark description of Musk's erratic and authoritarian way of doing business. The former executives say the mogul showed “private anger” toward them after he acquired the social network in 2022, publicly promising to withhold their compensation to recover about $200 million of the $44 billion operation, according to the lawsuit filed Monday in federal court. In Northern California. The reason: “They adequately and vigorously represented the interests of Twitter's public shareholders throughout Musk's illegitimate attempt to renege on the agreement. “Musk promised “With lifelong vengeance for his efforts.”

“Under Musk’s control, Twitter has become a criminal, defrauding employees, landlords, suppliers, and others. Musk doesn’t pay his bills, believes the rules don’t apply to him, and uses his wealth and power to trample anyone who disagrees with him,” they add.

The lawsuit repeats the takeover description in Walter Isaacson's biography of Musk, in which the early closure of the operation was presented as a masterstroke to avoid paying damages. “As Musk was about to close the acquisition, he told his official biographer, Walter Isaacson, that he would ‘hound every single one’ of Twitter’s executives and managers ‘until the day they died.’” These statements were not just the rants of a self-absorbed billionaire surrounded by unwilling people. Face the legal consequences of their decisions. “Musk bragged to Isaacson specifically about how he planned to defraud Twitter executives out of severance packages to save $200 million for himself.”

They point out that “if anyone around Musk had been willing to tell him the truth, they would have known about his plan.” [de adelantar el cierre de la operación y despedirles como despido procedente antes de que dimitieran por cambio de control] Depriving the plaintiffs of their contractual remedies was a futile effort that would not stand up to legal scrutiny.

They explain that the “cause” for appropriate severance in compensation plans is limited to very limited circumstances, such as conviction of a serious crime or commission of gross negligence or willful misconduct. But board-approved business decisions that Musk doesn't like from the time before he owned the company are not considered a justifiable reason.

In early December, also in December, a judge in San Francisco denied them 50% of the payments.

More legal fronts

Elon Musk's legal fronts are multiplying after the setback he suffered when a judge canceled a record bonus of up to $56 billion that the CEO had allocated to Tesla through the board of directors. Now, the lawyers who were able to overturn this package have asked the judge to award them shares in the company worth $5.6 billion as legal fees, i.e. 10% of the lawsuit amount. If approved, the compensation will be the largest of its kind. Lawyers in cases arising from Enron's bankruptcy collected a record $688 million in legal fees in 2008. Lawyers say this amount is justified because they would not have been paid if they had lost, and the benefits Tesla accrued from Repeal pay package 'has shrunk'. “It was huge.”

For his part, Musk filed a lawsuit last week against OpenAI, the company responsible for ChatGPT, its CEO, Sam Altman, and other senior officials in the organization, such as Greg Brockman (president of OpenAI), for abandoning the original mission. The company he co-founded: Contributing to the development of artificial intelligence (AI) in a selfless and non-profit way, for the benefit of humanity.

Follow all information Economy And a job in Facebook And sor in our Weekly newsletter

Five-day agenda

The most important economic quotes of the day, with keys and context to understand their scope.

Get it in your email

“Social media evangelist. Student. Reader. Troublemaker. Typical introvert.”

/cloudfront-us-east-1.images.arcpublishing.com/eluniverso/K6B4EBVL4VE2PLG66NGF3IIBF4.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/MNF7C5PDZJH7HPFPQZU4XRCBIA.jpg)

More Stories

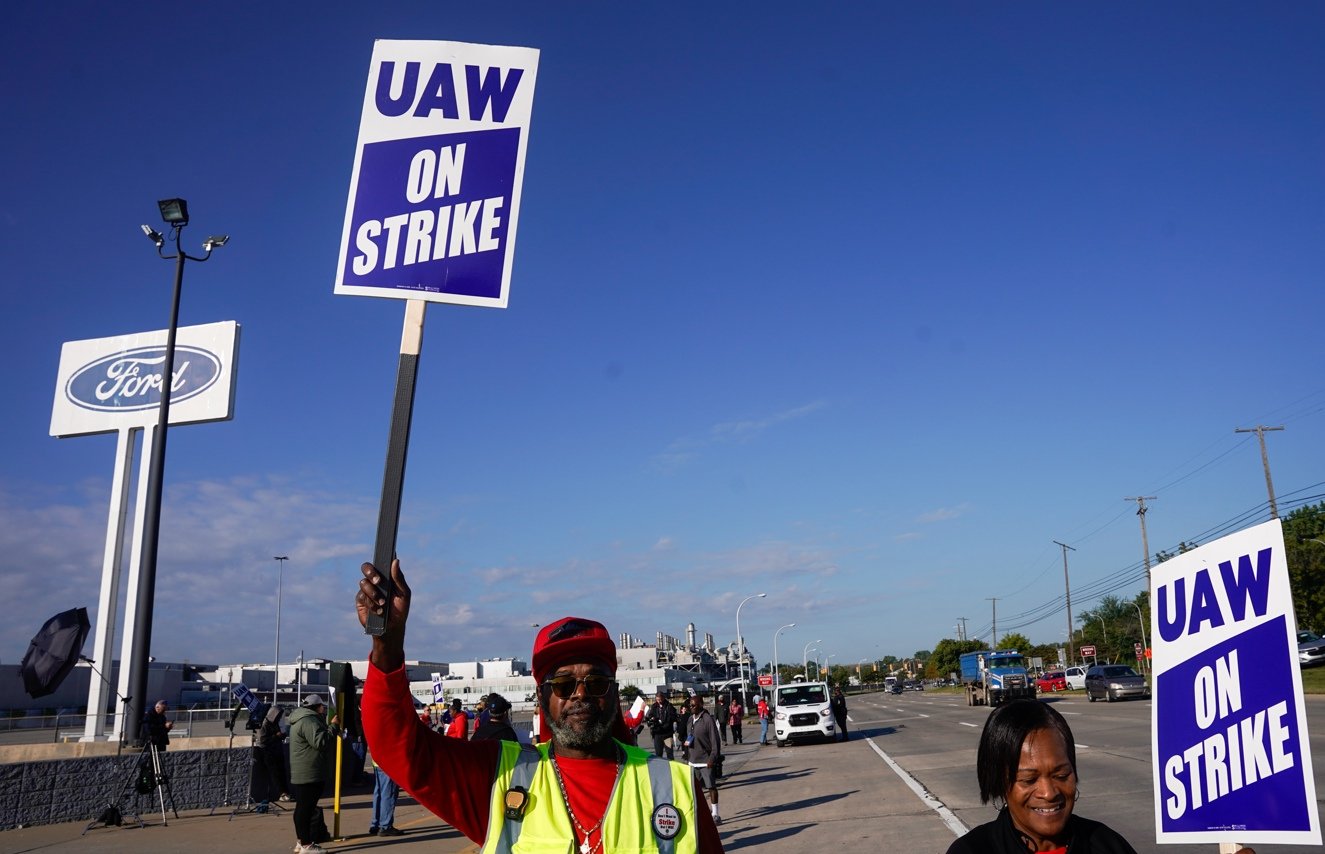

UAW loses vote to consolidate Mercedes-Benz plant in Alabama

US banks that offer a bonus of up to $3,000 for opening an account

Are you just looking for remote jobs? This is how you should include it on your resume