The judge New taxes were introduced on persons and entities not resident in Colombia that provide services in the national territory. The entity reported that this would be done through the mechanism of deduction at source or by submitting an income tax return and that since January 1, taxes on the large economic presence, PES, have begun to take control.

It should be noted that the Effective Tax System for Important Economic Existence (PES) established by the National Directorate of Taxes and Customs, Dian, is located, in accordance with the Tax Code,To non-resident persons and entities of Colombia that generate income from the sale of goods and/or provision of services to customers and/or users located in the national territory.

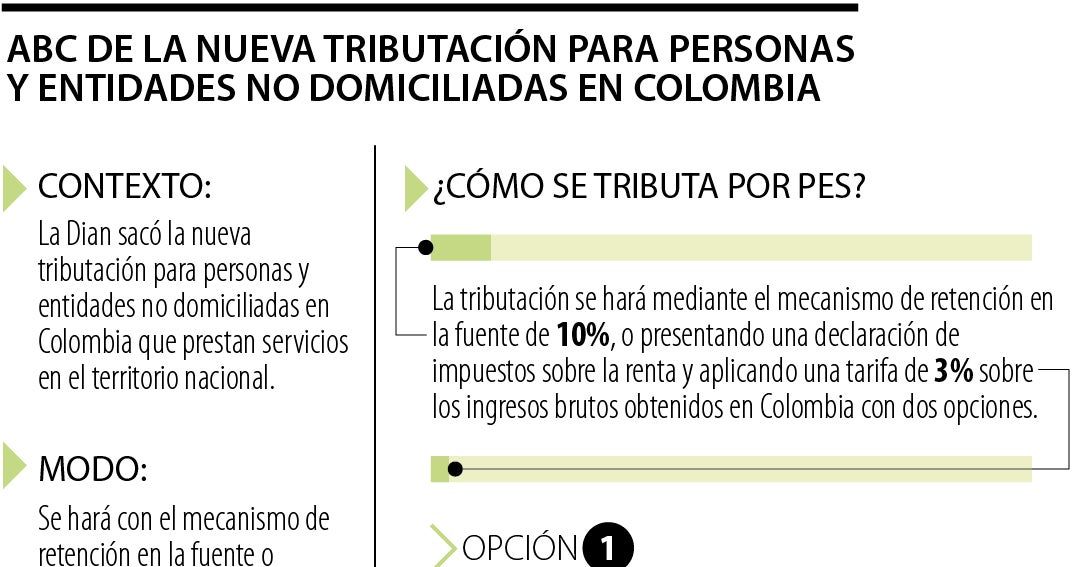

How is PES taxed?

Depending on the entity, this tax will be done through a 10% withholding mechanism at source, or through submitting an income tax return and Apply a rate of 3% to the total income earned in Colombia with two options.

The first is to declare and pay income taxes and supplementary taxes, using the form prepared for this purpose, in the opportunities determined by the national government. In this case, the taxpayer must choose between not applying deduction at source (subsection 8 of Article 408 of the Tax Law) or applying it. The second is to pay this tax through deduction at the source, which is what Paragraph 8 of Article 408 of the tax system expresses.

How to register or update RUT with tax liability on PES?

Persons subject to PES tax can request registration or update of the RUT, Submit the documents required in Section 11 of Article 1.6.1.2.11. From Decree No. 1625 of 2016, through the following channels such as the “PQSR and Complaints” service on the Dayan website or scheduling virtual appointments, In this link.

What documents must be submitted?

It is divided into two parts, in the case of natural persons you must have a copy of the identity document. But in the case of companies and entities, there must be a copy of the documents proving their existence and legal representation (in Spanish) duly certified or certified. If these documents do not contain information about the country of tax residence, Tax identification number, main address, postal code, telephone numbers, website and email, and these data must be certified by the legal representative or legal agent through a document in Spanish or translated by an official translator and a copy of the legal representative’s identity document.

“Music buff. Social media lover. Web specialist. Analyst. Organizer. Travel trailblazer.”

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/SXDWOIO7O5FMZOWUATFEXQYWTY.jpg)

More Stories

They condemn the irregularities that occurred in the installation of voting tables in the presidential elections in Venezuela.

At least 50 Cubans stranded in Peru after flight to Nicaragua canceled

Censorship in Venezuela: Condemn Chavism’s Blockade of Three Media Days Ahead of Elections